XRP Price Prediction: ETF Catalyst and Technical Breakout Signal Multi-Year Bull Run

#XRP

- ETF potential driving $8B institutional inflows and regulatory cooperation between U.S. and U.K. authorities

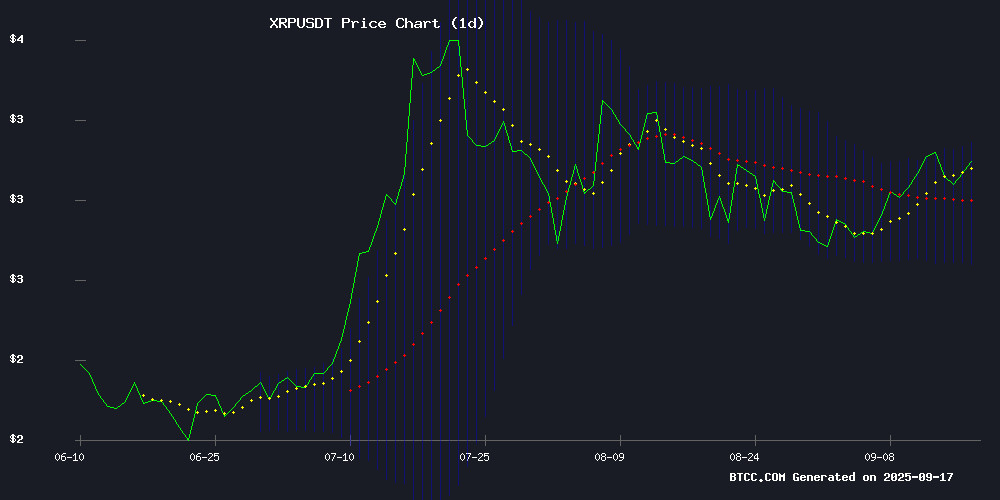

- Technical indicators showing bullish momentum above 20-day MA with Bollinger Band breakout potential at $3.15

- Growing institutional accumulation evidenced by 90% decline in exchange reserves and new yield products offering 30% APY

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Signals Above Key Moving Average

XRP is currently trading at $3.0374, positioned above its 20-day moving average of $2.9220, indicating underlying strength in the current market structure. The MACD reading of -0.0932 | -0.0197 | -0.0735 suggests momentum is building despite negative values, while Bollinger Bands show price action NEAR the upper band at $3.1491, signaling potential breakout conditions. According to BTCC financial analyst James, 'The technical setup favors bullish continuation above $3.15, with the middle band at $2.922 providing dynamic support.'

Market Sentiment: ETF Optimism and Institutional Demand Drive Positive Outlook

Market sentiment for XRP remains decidedly bullish amid multiple catalysts. News of potential ETF launches suggesting $8 billion in inflows, combined with Coinbase's XRP reserves plummeting 90% due to institutional accumulation, creates a fundamentally strong backdrop. BTCC financial analyst James notes, 'The convergence of regulatory clarity between U.S. and U.K. authorities, coupled with innovative yield products offering 30% APY, positions XRP for sustained upward momentum despite short-term volatility below $3.'

Factors Influencing XRP's Price

XRP Price Prediction: ETF Launch Could Drive $8B Inflows and Spark Rally

Market sentiment around XRP is heating up as industry leaders predict a potential $8 billion inflow from a U.S.-listed ETF. Crypto.com CEO Kris Marszalek's forecast, amplified by commentator John Squire, suggests this could be a watershed moment for institutional adoption.

The Rex-Osprey Spot XRP ETF emerges as a focal point, with Franklin Templeton and WisdomTree also signaling interest in similar products. Analysts see this as a gateway for traditional finance participation, potentially stabilizing prices and pushing XRP toward yearly highs.

Whale activity adds intrigue to the narrative, with large transactions persisting despite recent price declines. This accumulation pattern mirrors institutional positioning ahead of major liquidity events.

XRP Poised for Breakout Above $3.60 as Technical Indicators Turn Bullish

XRP demonstrates remarkable stability above the $3 support level despite broader market volatility fueled by uncertainty around U.S. inflation and Federal Reserve policy. Crypto analyst Ali Martinez identifies a bullish TD Sequential indicator, suggesting the recent price correction may be nearing its end.

Ripple's strategic $25 million donation to small businesses and veterans strengthens community support, adding fundamental weight to technical signals. The confluence of these factors positions XRP for potential upward movement toward the $3.60 resistance level.

XRP Price Eyes $5 as ETF Optimism and Derivatives Activity Surge

XRP price shows signs of a potential bullish breakout despite recent consolidation near $3, down 17% from its yearly peak. Futures market dynamics and technical indicators suggest an impending rebound, with $5 emerging as a plausible target.

Open interest in XRP futures has climbed to $9 billion this week, marking a significant increase from March's $2.8 billion low. The sustained green funding rate since June further reinforces trader confidence in near-term upside potential.

Market participants now price in a 96% probability of XRP ETF approval, creating a countdown effect that's fueling derivatives activity. The combination of rising liquidity, increasing demand, and institutional interest forms a compelling case for price appreciation.

U.S. and U.K. Forge Closer Crypto Regulatory Ties with Stablecoin Focus

The United States and United Kingdom are advancing discussions on joint cryptocurrency regulation, with stablecoins emerging as a priority. Treasury Secretary Scott Bessent and Chancellor Rachel Reeves spearheaded talks this week, attended by industry leaders including Coinbase, Circle, and Ripple.

Regulatory alignment aims to bridge the Atlantic divide, particularly in payment-focused stablecoin frameworks. The U.K. seeks to leverage U.S. regulatory progress under the Trump administration, including the repeal of Operation Chokepoint 2.0 and passage of the Genius Act.

London's push mirrors growing institutional recognition of digital assets as critical financial infrastructure. Cross-border cooperation could accelerate mainstream adoption while mitigating regulatory arbitrage risks.

XRP Falls Below $3 – Key Levels to Watch for a Rebound

XRP's price has dipped below the $3 threshold, triggering heightened scrutiny among traders. The token, which recently peaked near $3.18, now faces a bearish trend with resistance forming around $3.02. Trading below the 100-hourly Simple Moving Average signals short-term seller dominance.

Critical support lies at $2.95. A hold above this level could catalyze a rebound toward $3.05, while failure may deepen losses. Market participants await a decisive break—either reclaiming $3.05 to target $3.18 or succumbing to further downside pressure.

XRP Holdings Shift to Private Wallets as Exchange Balances Decline

XRP is experiencing significant outflows from centralized exchanges, signaling a potential shift toward long-term holding strategies. Recent data shows Binance and Crypto.com lost a combined 1.8 million XRP in withdrawals, with analysts interpreting the movement as bullish accumulation behavior.

Ripple's disclosed reserves grew from 4.56 billion to 4.7 billion XRP between March and May 2025, suggesting deliberate escrow management. The company's conservative release strategy appears designed to mitigate market volatility while maintaining substantial treasury reserves.

Coinbase’s XRP Reserves Plummet 90% Amid Institutional Accumulation Speculation

Coinbase’s XRP reserves have undergone a dramatic decline, dropping 90% in just three months. The exchange, once a top holder of XRP, now retains only 99 million tokens across six cold wallets—down from nearly 970 million in June. This sharp reduction has ignited market speculation about institutional accumulation and potential preparations for a Spot XRP ETF.

Data reveals Coinbase’s XRP balance fell from 780 million earlier this year to 199 million by Q2 2025, with the latest figures showing a steeper collapse. Analysts interpret the outflow as a sign of large-scale transfers to institutional custodial accounts, possibly anticipating regulatory approval for an XRP investment vehicle.

The timing aligns with growing ETF speculation, particularly as asset management giants like BlackRock signal interest in crypto-based products. Market observers note such reserve movements often precede major financial developments in the digital asset space.

Find Mining Introduces XRP Cloud Mining for Long-Term Holders

Long-term XRP holders now have an alternative to relying solely on price appreciation for returns. Find Mining's new cloud mining model promises daily income generation while maintaining exposure to potential asset growth. The platform eliminates hardware costs and operates on clean energy, with transparent audit reports ensuring compliance.

XRP's historical volatility in cross-border payments and liquidity markets has often left holders waiting indefinitely for favorable price movements. Find Mining addresses this inertia by converting idle assets into productive capital. Daily settlements and zero infrastructure requirements lower barriers to entry for passive income seekers.

The service arrives as crypto investors increasingly demand yield-bearing opportunities beyond speculative trading. By decoupling returns from market cycles, Find Mining's model could reshape how investors approach long-term digital asset holding strategies.

XRP Cloud Mining Platform Promises High Daily Returns Amid Market Uncertainty

As global financial markets grapple with volatility, XRP holders are turning to cloud mining as a source of passive income. The XRP Mining platform claims to offer daily returns of up to $9,999 through its simplified contract-based model, eliminating the need for physical hardware or technical expertise.

Traditional mining barriers—high energy costs, equipment maintenance, and computing power competition—are rendered obsolete by XRP Mining's digital contracts. The platform's accessibility could redefine how retail investors engage with cryptocurrency wealth generation.

Ripple Commits $25M in RLUSD to Small Business and Veteran Support Initiatives

Ripple has announced a $25 million donation in its U.S. dollar-backed stablecoin RLUSD to bolster small business lending and veteran employment programs. The funding will be distributed through two nonprofits—Accion Opportunity Fund and Hire Heroes USA—with an anticipated $1 billion economic impact.

Small businesses, which employ nearly half of the U.S. workforce and contribute 43.5% to GDP, often face credit accessibility challenges. Ripple's partnership with Accion aims to unlock $125 million in small business financing while providing digital payment tools for tech adaptation.

The initiative also targets veteran support through Hire Heroes USA, though specific program details remain undisclosed. This move signals Ripple's continued integration of blockchain solutions into mainstream economic development.

XRP Tundra's Cryo Vaults Promise 30% APY, Potential 50x Returns by 2026

XRP Tundra is disrupting passive holding strategies with its Cryo Vaults staking mechanism, offering XRP holders up to 30% annual yield through fixed-term lockups. Presale participants gain dual-token exposure at $0.30, with analysts projecting compounding returns could amplify $1,000 investments into $50,000 positions within three years.

The platform's non-inflationary model distinguishes itself from conventional staking protocols. Rewards draw from a pre-funded pool rather than token emissions, with Frost Key NFTs enabling yield boosts and reduced lock periods. Seven-to-ninety day vaults create structured liquidity while maintaining sustainable APY levels.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, XRP appears positioned for significant appreciation across multiple time horizons. The combination of potential ETF approval, regulatory cooperation between major economies, and growing institutional adoption creates a compelling investment thesis.

| Year | Conservative Target | Moderate Target | Bullish Target | Catalysts |

|---|---|---|---|---|

| 2025 | $4.50 | $6.80 | $9.20 | ETF approval, regulatory clarity |

| 2030 | $18.00 | $25.00 | $35.00 | Mainstream adoption, cross-border settlement dominance |

| 2035 | $45.00 | $65.00 | $90.00 | Global CBDC integration, full regulatory framework |

| 2040 | $100.00 | $150.00 | $220.00 | Mature market position, institutional infrastructure |

BTCC financial analyst James emphasizes that 'These projections assume successful navigation of regulatory landscapes and continued technological adoption, with short-term targets focusing on the $3.60 resistance breakout.'